Always Be Ready To Sell Your Business: Part 3 of 5

Without monitoring financials and forecasting, it’s like trying to fly a plane without an instrument panel. Not a good idea..

A team needs to know where the ship is headed and why the captain is making the decisions that he is, otherwise they take no ownership for the results of their actions.

Are you ready to sell your business?

Welcome to Part 3 of our 5 part series, ‘Always Be Ready To Sell Your Business’ that touches on many of the common areas of improvement that, if addressed, can keep your company running in tip top condition. Sometimes it’s hard to turn heads down and address the things that need to be done to ensure that your company is as efficient and scalable as it can be, but you need to challenge yourself to do so.

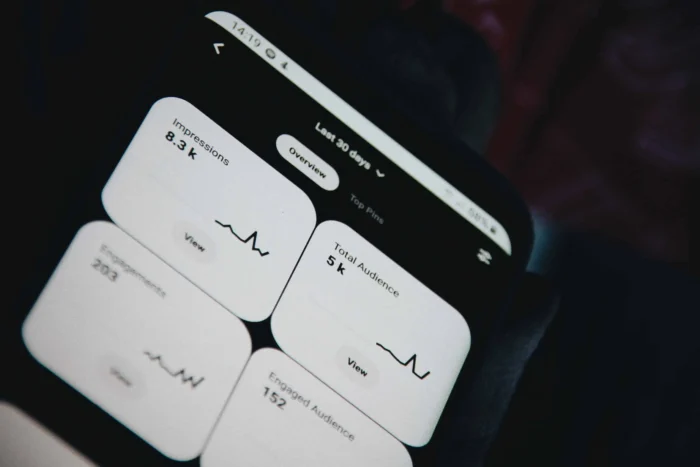

This week, I want to go over your accounting practices. Keep monthly or at least quarterly financials up to date. Not seeing where your money is coming from and where it is going kills any chances of proper fiscal planning for the future. Without this, it is like trying to fly a plane without an instrument panel. Not a good idea. This is another task that gets more daunting the longer you put it off. Stay on top of it, and be worry free, or deal with the constant agony known only by the souls of procrastinators. Here are some tips to help:

- Hire someone to maintain your company’s financials. Outsourcing to a local firm is great if you don’t have the resources in house. Referrals from other companies you trust is a great place to start. Most likely, even if you have an in-house accounting resource, you don’t have a CPA in house. To save money, always use in house resources (which might be you) to code all financial statements before sending them to your accounting firm. Coding expenses and income is not skilled labor and accountants are not cheap, so keep this in mind and save money.

- Regularly review your financials so that you are always up to speed on the heath of your balance sheet. Here is a great link on how to read a balance sheet, and income statement.

- Instead of trying to create annual budgets, instead maintain a rolling forecast. The rolling forecast model is so much more preferable to the old school, painless and often pointless annual forecasting efforts that many of us dread. There are lots of great articles online about rolling forecasts; here is one of my favorites. This approach to business planning allows you to stay nimble and react to business environment changes. Regular monthly meetings instead of the old habit of annual budgeting where future plans grow more inaccurate and shorter in foresight as the year progresses. Most importantly, it keeps managers accountable for their results in a real time manner, a dynamic that is completely missing from most organizations in my experience.

- Keep your entire team in the loop on the financial state of your company. Its earnings and other important metrics by which they should share in for celebration or the identification of areas that need addressing. A team needs to know where the ship is headed and why the captain is making the decisions that he is, otherwise they take no ownership for the results of their actions.

- Most importantly, document your goals, and measure the variance of actuals to budget and use those numbers to track and manage your business’ performance.

Stay tuned next week for Part #4: Clear Definitions of Roles & Responsibilities!